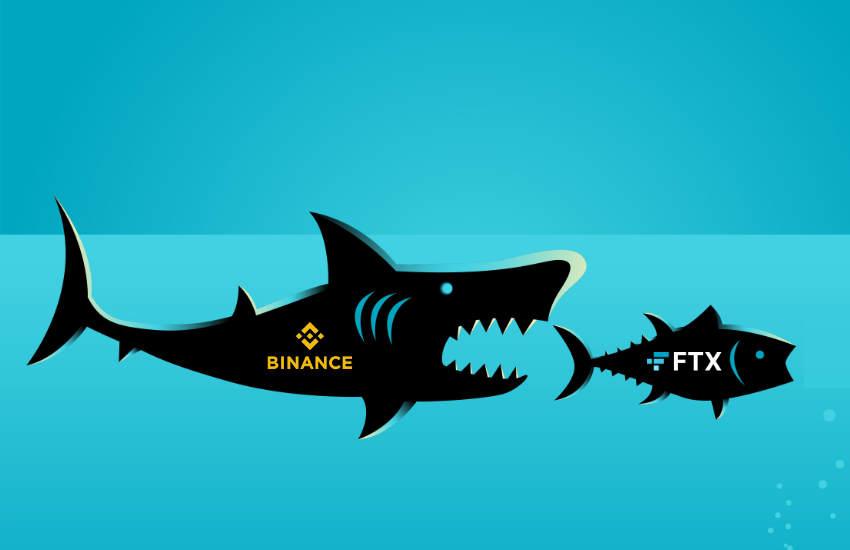

Binance, the world's largest crypto exchange by volume, has signed a letter of intent to acquire rival FTX, the third largest exchange by volume. The acquisition comes after a CoinDesk article sparked speculation about FTX's balance sheet. Binance CEO Changpeng Zhao (CZ) announced the acquisition of FTX.com, the non-US arm of the FTX cryptocurrency exchange.

Also Read: What is SEO, Why and How to Analyze SEO?

Effect of the Agreement

CZ said on Twitter, "This afternoon FTX asked for our help. There is a serious liquidity crunch. To protect users, we have signed a non-binding LOI to fully acquire FTX.com and help address the liquidity crunch. We will conduct a full DD in the coming days." FTX CEO Sam Bankman-Fried said, "The important thing is customer protection. I know there have been media rumors of conflict between our two exchanges, but Binance has repeatedly demonstrated their commitment to a more decentralized global economy as they work to improve industry relations with regulators. We are in the best hands."

On the one hand, if FTX users are protected, it seems like good news for the cryptocurrency industry. But it could be better for competition. Binance is already the dominant exchange internationally, with Coinbase in second place, accounting for around 20 percent of its volumes. FTX was one of its promising competitors.

It also raises a number of regulatory questions. These include why regulators have been so slow to regulate centralized exchanges after the collapse of several crypto lenders? What started FTX and what triggered the sudden collapse in the FTT token price in particular. There may also be a shortage of funds to support the price.

No comments yet for this news, be the first one!...